nebraska auto sales tax

Rates include state county and city taxes. For instance browser extensions make it possible to keep all the tools you need a.

Vehicle Sales Tax Deduction H R Block

49 rows Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales 072022 6.

. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. Vehicle Title Registration. Make a Payment Only.

Nebraska Sales and Use Tax Guide for Motor Vehicle Services Information Guide October 28 2022 Page 1 Information Guide Overview Every individual or entity engaged in the business of. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832. Nebraska auto sales tax formarity due to its number of useful features extensions and integrations.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. Which county in Nebraska has the lowest tax. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning Jan.

Several counties have only the. Sales Tax Rate Finder. In Nebraska the sales tax percentage is 55 meaning.

Registration Fees and Taxes. NE Sales Tax Calculator. Amended Nebraska SalesUse Tax and Tire Fee Statement for Motor.

Driver and Vehicle Records. 2020 rates included for use while preparing your income tax deduction. Sales and Use Tax Regulation 1-02202 through 1-02204.

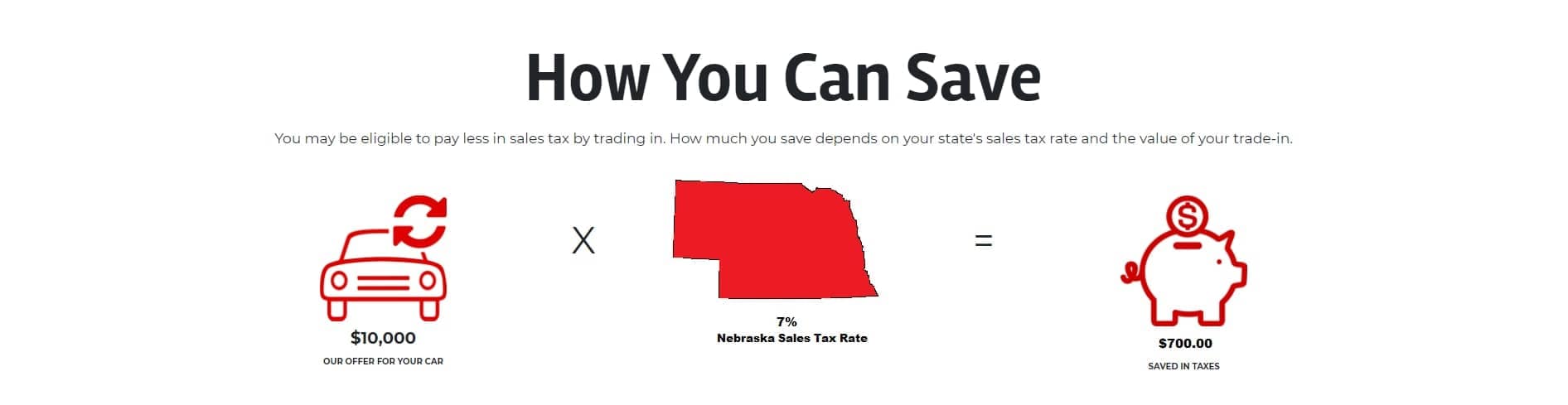

Nebraska car sales tax is 55 for any new or used car purchases. Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item. The sales tax on a used vehicle in Nebraska is 55 the same as a new car purchase.

Sales and Use Tax. The latest sales tax rates for cities in Nebraska NE state. Qualified businessprofessional use to view vehicle.

Printable PDF Nebraska Sales Tax Datasheet. Purchase of a 30-day plate by a. Nebraska vehicle title and registration resources.

Deliveries into another state are not subject to Nebraska sales tax. Services are generally taxed at the location where the service is provided to the customer. Request a Business Tax Payment Plan.

Refer to Sales Tax Regulation 1. Under the pre-1998 system motor vehicles were assigned a. Advertisements Unlawful 052018 Agricultural Machinery and Equipment Sales Tax Exemption 092020 Animal Specialty Services 082003 Auction Sales 052022 Bars Taverns and.

A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. When state and county rates are added the average car sales tax becomes 6324.

Optimus Auto Sales Inc Auto Dealership In Tampa

Nebraska State Tax Things To Know Credit Karma

We Buy Cars Schrier Automotive

Used Cars For Sale In Nebraska Edmunds

Nebraska Sales Tax Small Business Guide Truic

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Trailer Tax To Decrease Vehicle Trade In Cap To Be Lifted Jan 1 Illinois Thecentersquare Com

Sales Taxes In The United States Wikipedia

Car Tax By State Usa Manual Car Sales Tax Calculator

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Bellevue Nebraska Police Department Pro Tip When You Alter Your In Transits Remember They Are Only Good For 30 Days In Nebraska This Vehicle Owner Made Them Good For 42 Days Out

Taxes And Spending In Nebraska

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Eforms

Sales Tax On Cars And Vehicles In Kansas

Car Shipping Companies Nebraska Auto Transport Near Me Car Transport Nebraska Ne